Vehicle Sales Tax In Ms . In addition to taxes, car purchases in. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. when you buy a car in mississippi, you owe sales tax. The 5% tax applies to purchases from car dealers as well as private party. the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag.

from www.freetheibo.com

the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: when you buy a car in mississippi, you owe sales tax. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. The 5% tax applies to purchases from car dealers as well as private party. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. In addition to taxes, car purchases in.

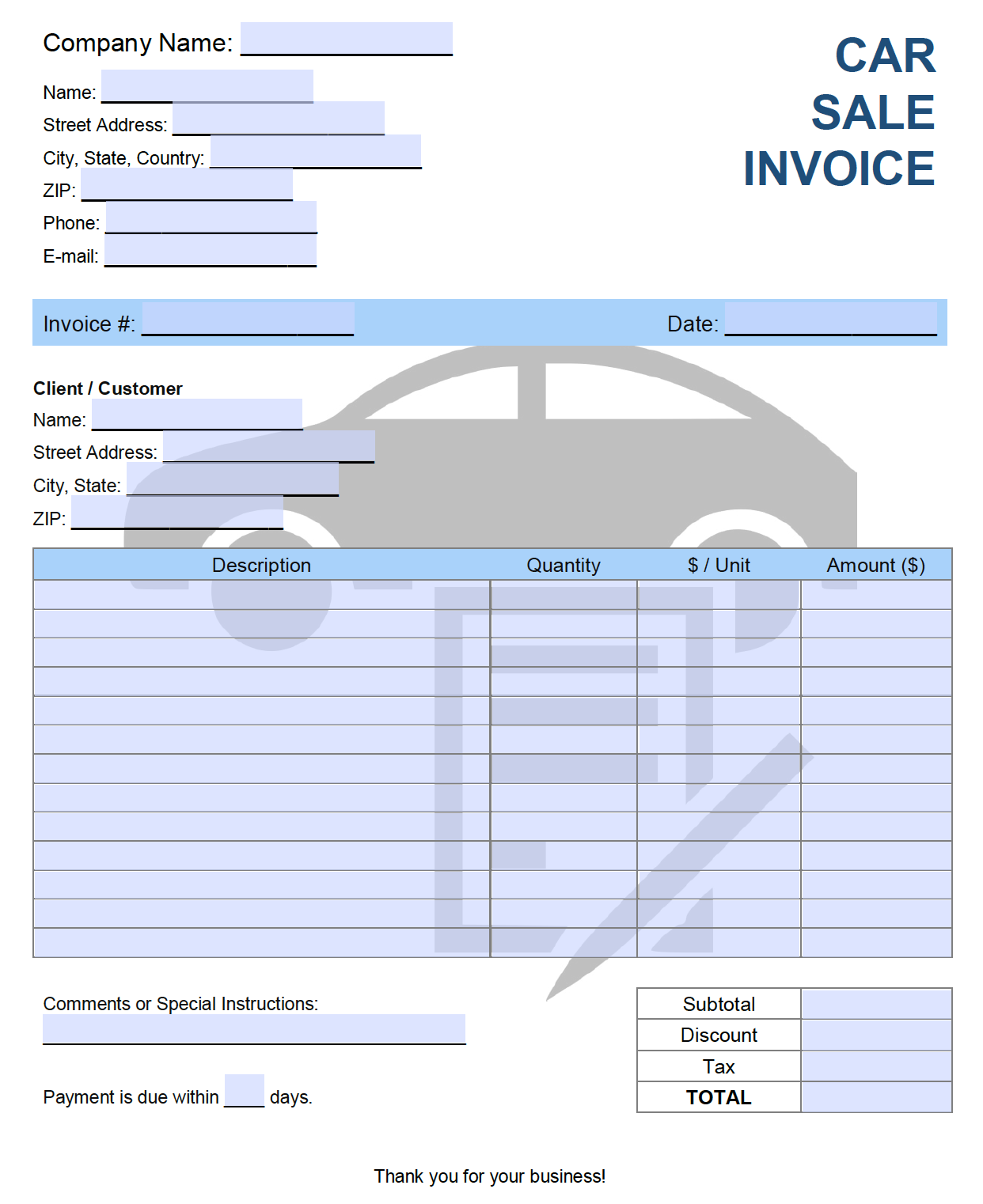

Car Sales Invoice Template Free Download

Vehicle Sales Tax In Ms mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. when you buy a car in mississippi, you owe sales tax. the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: In addition to taxes, car purchases in. The 5% tax applies to purchases from car dealers as well as private party. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code.

From www.sampletemplates.com

FREE 8+ Sample Bill of Sale for Vehicle Templates in MS Word PDF Vehicle Sales Tax In Ms when you buy a car in mississippi, you owe sales tax. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: In addition to taxes, car purchases in. you can. Vehicle Sales Tax In Ms.

From musterlehrer-0.netlify.app

Free Vehicle Bill Of Sale Template Fillable Pdf Vehicle Sales Tax In Ms The 5% tax applies to purchases from car dealers as well as private party. In addition to taxes, car purchases in. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use. Vehicle Sales Tax In Ms.

From flyfin.tax

How To Write Off A Car For Business A 1099 Guide Vehicle Sales Tax In Ms mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. In addition to taxes, car purchases in. The 5% tax applies to purchases from car dealers as well as private party. . Vehicle Sales Tax In Ms.

From www.youtube.com

TCSLC Vehicle Sales Tax YouTube Vehicle Sales Tax In Ms when you buy a car in mississippi, you owe sales tax. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. The 5% tax applies to purchases from car dealers. Vehicle Sales Tax In Ms.

From www.formsbirds.com

Motor Vehicle Certificate of Payment of Sales or Use Tax Free Download Vehicle Sales Tax In Ms In addition to taxes, car purchases in. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. The 5% tax applies to purchases from car dealers as. Vehicle Sales Tax In Ms.

From www.sampletemplates.com

FREE 9+ Sample Vehicle Bill of Sale Templates in PDF MS Word Vehicle Sales Tax In Ms In addition to taxes, car purchases in. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. The 5% tax applies to purchases from car dealers as well as private party. when you buy a car in mississippi, you owe sales tax. you can use our mississippi. Vehicle Sales Tax In Ms.

From printable.unfs.edu.pe

Free Printable Vehicle Bill Of Sale Mississippi Vehicle Sales Tax In Ms you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. when you buy a car in mississippi, you owe sales tax. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. 455 rows — mississippi has state sales tax. Vehicle Sales Tax In Ms.

From exoyenypj.blob.core.windows.net

Car Sales Tax Rate Missouri at Adam Baxter blog Vehicle Sales Tax In Ms 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. In addition to taxes, car purchases in. mississippi collects a 3% to. Vehicle Sales Tax In Ms.

From opendocs.com

Free Mississippi Bill of Sale Forms (5) PDF WORD RTF Vehicle Sales Tax In Ms when you buy a car in mississippi, you owe sales tax. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. In addition to taxes, car purchases in. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. the. Vehicle Sales Tax In Ms.

From foundationfalo.weebly.com

Used vehicle bill of sale template microsoft word foundationfalo Vehicle Sales Tax In Ms In addition to taxes, car purchases in. The 5% tax applies to purchases from car dealers as well as private party. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect. Vehicle Sales Tax In Ms.

From usedvehiclesaleswosawaki.blogspot.com

Used Vehicle Sales Used Vehicle Sales Tax Vehicle Sales Tax In Ms mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. The 5% tax applies to purchases from car dealers as well as private party. 455 rows — mississippi has state. Vehicle Sales Tax In Ms.

From www.carsalerental.com

How Much Is Car Sales Tax In Missouri Car Sale and Rentals Vehicle Sales Tax In Ms when you buy a car in mississippi, you owe sales tax. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%.. Vehicle Sales Tax In Ms.

From www.template.net

Free Vehicle Sale Receipt Template in Microsoft Word, Excel, Apple Vehicle Sales Tax In Ms 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in. in mississippi, you pay privilege tax, registration fees, ad. Vehicle Sales Tax In Ms.

From www.freetheibo.com

Car Sales Invoice Template Free Download Vehicle Sales Tax In Ms the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. The 5% tax applies to purchases from car dealers as well as private. Vehicle Sales Tax In Ms.

From blog.gulflive.com

News from The Mississippi Press Vehicle Sales Tax In Ms when you buy a car in mississippi, you owe sales tax. the following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in. in mississippi,. Vehicle Sales Tax In Ms.

From taxfoundation.org

Combined State and Average Local Sales Tax Rates Tax Foundation Vehicle Sales Tax In Ms in mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag. you can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address / zip code. mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles.. Vehicle Sales Tax In Ms.

From ar.inspiredpencil.com

Sales Tax By State Chart Vehicle Sales Tax In Ms mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. the following are subject to sales tax equal to 7% of the gross income of the. Vehicle Sales Tax In Ms.

From www.eidebailly.com

State Tax News & Views Auditor shortage. Supremes worry states. Vehicle Sales Tax In Ms In addition to taxes, car purchases in. when you buy a car in mississippi, you owe sales tax. 455 rows — mississippi has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 1%. you can use our mississippi sales tax calculator to look up sales tax rates. Vehicle Sales Tax In Ms.